Buying a property is a major life event and you may be moving into the property with a partner, spouse or even friends. You will want to protect your investment for the future, and so you will doubtless undertake as much research as possible as to how you do that.

What is a declaration of trust?

A declaration of trust is a legal document which spells out the beneficial interests associated with the property. It comes into play when or if the property is sold and helps to establish how the proceeds will be divided. It will also confirm the manner in which ownership and shares pass to an estate if one or more of the people registered as owners passes away.

It can also determine the management of the property, that is to say, how any mortgages, repairs or outgoings on the property are paid for.

You will need to factor the declaration of trust cost into your purchasing finances, but it is important to understand that it is there to protect the investment you have made. You will find plenty of information about these documents online at sites such as Sam Conveyancing.

When is a trust necessary?

A declaration of trust is needed when the purchasers of a property wish to confirm the contributions they have made to the purchase and how they should impact upon the division of the proceeds when the property is sold.

For example two people may buy a property but make different contributions to a deposit before the mortgage. These contributions will be recorded and paid back after a sale and the redemption of the mortgage. You can also define these amounts as a percentage of the deposit and the same will apply.

Alternatively, one person may have paid the full amount of a renovation project. The trust will record this and that individual will be paid the full amount back before any residual proceeds are divided equally.

Finally, there is the alternative scenario to both of the above. You may wish to establish that one of the beneficiaries of a trust really has no financial interest in the property. Now you will have to consider a declaration of no interest in the property. This may involve the ending of a previous trust, possibly when a divorce occurs. Under these circumstances, you will need to lodge a Form A restriction on severance of a joint tenancy if one exists. You will find more information on this at the Land Registry.

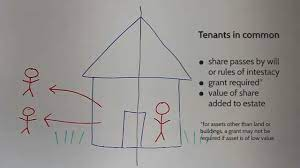

Tenants in Common vs Joint Tenants

If you own property as Tenants in Common, you own different shares in the property. If one person dies, their share does not pass automatically to the other, rather, it passes to whoever is named in their will. Joint Tenants, meanwhile, have equal rights and if one dies their share will pass automatically to the survivor and cannot pass to anyone else in a will.

Particular care needs to be taken to address this issue and the appropriate advice should be taken from a legal professional when a Trust is set up.

As you can see, it is important to consider this kind of trust when purchasing a property in order to protect your investment.